As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at industrial packaging stocks, starting with Graphic Packaging Holding (NYSE:GPK).

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 2.2%. while next quarter's revenue guidance was 2.1% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the industrial packaging stocks have fared somewhat better than others, they collectively declined, with share prices falling 3.7% on average since the previous earnings results.

Graphic Packaging Holding (NYSE:GPK)

Founded in 1991, Graphic Packaging (NYSE:GPK) is a provider of paper-based packaging solutions for a wide range of products.

ADVERTIsem*nT

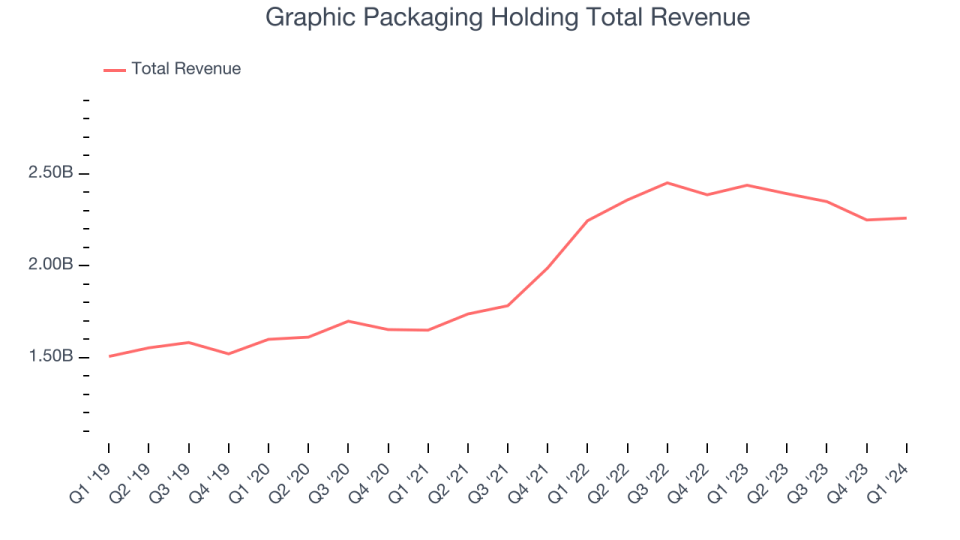

Graphic Packaging Holding reported revenues of $2.26 billion, down 7.3% year on year, falling short of analysts' expectations by 5.1%. It was a weak quarter for the company, with a miss of analysts' volume estimates and underwhelming EBITDA guidance for the full year.

Michael Doss, the Company's President and CEO said, "During the first quarter, our diverse consumer packaging portfolio performed broadly as expected. Sales improved sequentially compared to the fourth quarter of 2023, and we generated a solid 19.6% Adjusted EBITDA margin while choosing to significantly reduce bleached paperboard production to match supply with demand. We expect volumes to improve further in the second quarter, and, excluding the impact of the Augusta bleached paperboard sale, expect to generate positive sales growth in 2024, as we partner with customers to deliver the more circular, more functional, and more convenient packaging that consumers prefer.

The stock is down 7.8% since the results and currently trades at $25.67.

Read our full report on Graphic Packaging Holding here, it's free.

Best Q1: Sealed Air (NYSE:SEE)

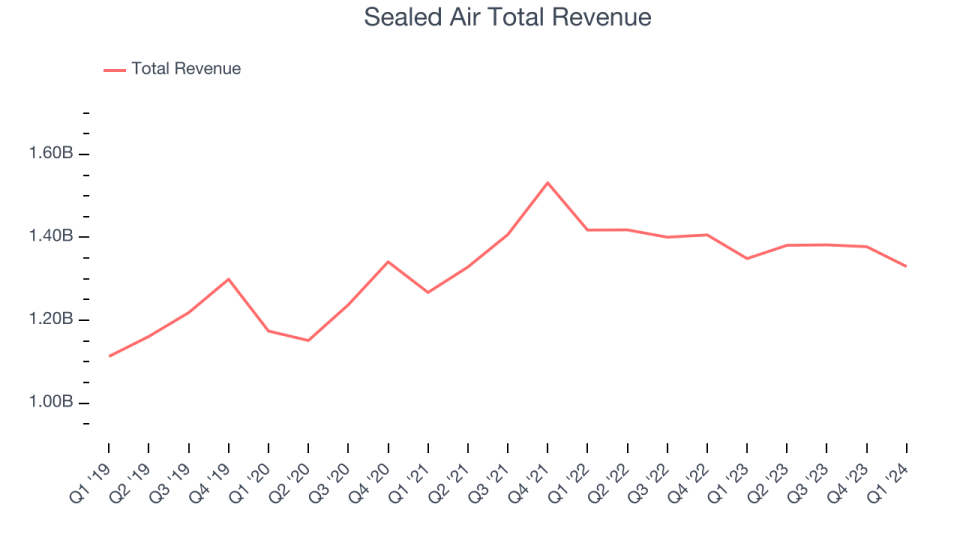

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

Sealed Air reported revenues of $1.33 billion, down 1.4% year on year, outperforming analysts' expectations by 3.8%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

Sealed Air delivered the biggest analyst estimates beat among its peers. The stock is up 7.9% since the results and currently trades at $34.62.

Is now the time to buy Sealed Air? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Silgan Holdings (NYSE:SLGN)

Established in 1987, Silgan Holdings (NYSE:SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Silgan Holdings reported revenues of $1.32 billion, down 7.1% year on year, falling short of analysts' expectations by 4.1%. It was a weak quarter for the company, with a miss of analysts' organic revenue estimates.

The stock is down 10.3% since the results and currently trades at $41.88.

Read our full analysis of Silgan Holdings's results here.

Crown Holdings (NYSE:CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Crown Holdings reported revenues of $2.78 billion, down 6.4% year on year, falling short of analysts' expectations by 5.1%. It was a weaker quarter for the company, with revenue missing analysts'estimates.

The stock is down 10.5% since the results and currently trades at $72.6.

Read our full, actionable report on Crown Holdings here, it's free.

Packaging Corporation of America (NYSE:PKG)

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products, also offering displays and protective packaging solutions.

Packaging Corporation of America reported revenues of $1.98 billion, flat year on year, surpassing analysts' expectations by 3.7%. It was an exceptional quarter for the company, with an impressive beat of analysts' volume estimates and a narrow beat of analysts' earnings estimates .

The stock is up 0.2% since the results and currently trades at $179.58.

Read our full, actionable report on Packaging Corporation of America here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.