editorial-team@simplywallst.com (Simply Wall St)

·4-min read

The Australian Securities Exchange (ASX) recently experienced a buoyant trading day, with the materials sector leading robust sector gains and overall indices closing up nearly 1.2%. Amidst this dynamic market environment, investors looking for steady income might consider the appeal of dividend stocks, which can offer regular payouts even in fluctuating markets.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.09% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.26% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.21% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.07% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.99% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.76% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.96% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.60% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.16% | ★★★★★☆ |

Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

ADVERTIsem*nT

Here we highlight a subset of our preferred stocks from the screener.

IGO

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company focused on metals crucial for clean energy, with a market capitalization of approximately A$4.45 billion.

Operations: IGO Limited generates revenue primarily through its Nova Operation and Forrestania Operation, which collectively contributed A$903.40 million to the company's earnings.

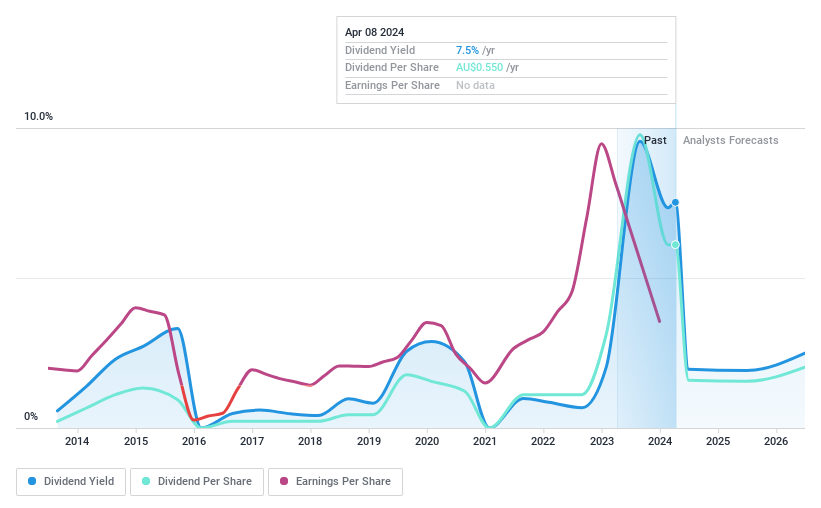

Dividend Yield: 9.3%

IGO Limited's dividend profile presents challenges for stability and reliability, with a history of volatile dividends over the past decade. Despite a high dividend yield at 9.34%, which ranks in the top 25% of Australian payers, these payments are not well supported by earnings or cash flow, evidenced by a payout ratio of 185%. However, dividends are somewhat covered by free cash flows due to a lower cash payout ratio of 39.7%. The recent appointment of Marcelo Bastos to the board could signal potential strategic shifts or stabilization efforts moving forward.

Lindsay Australia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited (ASX:LAU) operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors such as food processing and horticulture, with a market capitalization of A$296.80 million.

Operations: Lindsay Australia Limited generates revenue primarily through its transport and rural supply segments, with the transport segment contributing A$571.38 million and the rural segment adding A$158.73 million.

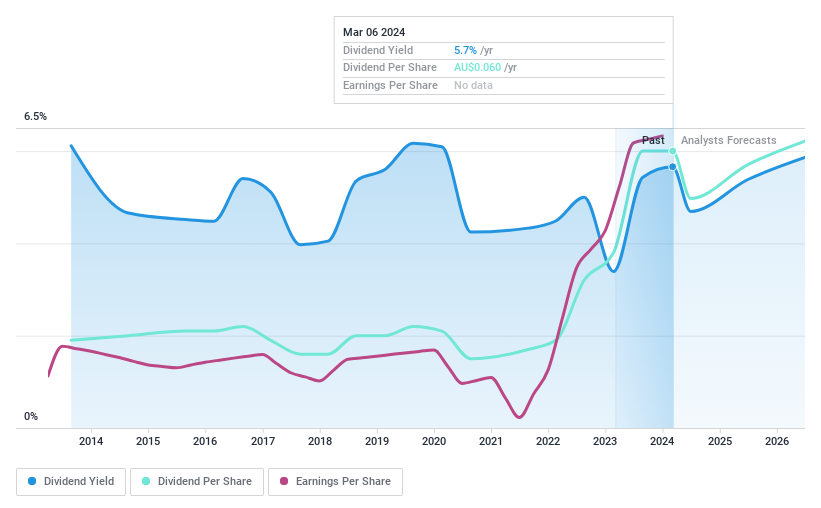

Dividend Yield: 6.3%

Lindsay Australia offers a modest dividend yield of 6.32%, slightly below the top quartile of Australian dividend stocks. Despite this, both earnings and cash flows robustly support its dividends, with payout ratios of 43.7% and 38.9% respectively. Dividend reliability has been an issue, however, as payments have shown volatility over the past decade. On a positive note, dividends have grown in the last ten years and earnings are expected to increase by 9% annually.

Macquarie Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited operates as a diversified financial services provider across regions including Australia, the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately A$74.73 billion.

Operations: Macquarie Group Limited generates revenue through five primary segments: Corporate (A$0.99 billion), Macquarie Capital (A$2.61 billion), Macquarie Asset Management (A$3.75 billion), Banking and Financial Services (A$3.21 billion), and Commodities and Global Markets (A$6.32 billion).

Dividend Yield: 3.1%

Macquarie Group's dividend yield of 3.12% trails behind the top Australian dividend payers, reflecting a low comparative return. Despite this, dividends are supported by earnings with a current payout ratio of 69.8%, and projections suggest continued coverage over the next three years at 63%. However, Macquarie has experienced instability in its dividend payments over the past decade, indicating potential unreliability for consistent income-focused investors. Recent activities include exploring acquisitions in primary healthcare alongside Medibank Private Limited, suggesting strategic expansion efforts which could impact future financial stability and dividend sustainability.

Dive into the specifics of Macquarie Group here with our thorough dividend report.

Our valuation report here indicates Macquarie Group may be overvalued.

Key Takeaways

Reveal the 27 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:IGO ASX:LAU and ASX:MQG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com